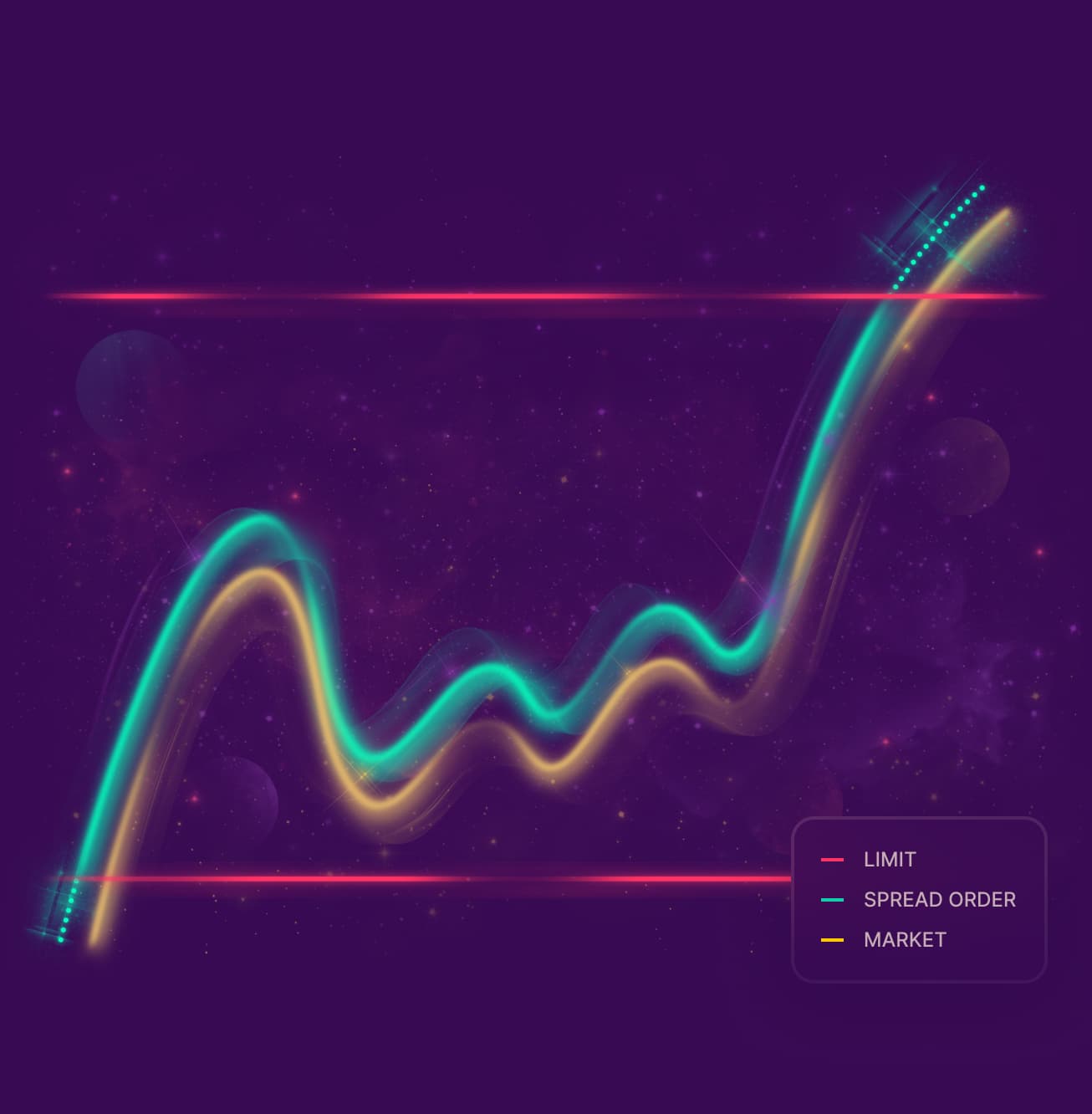

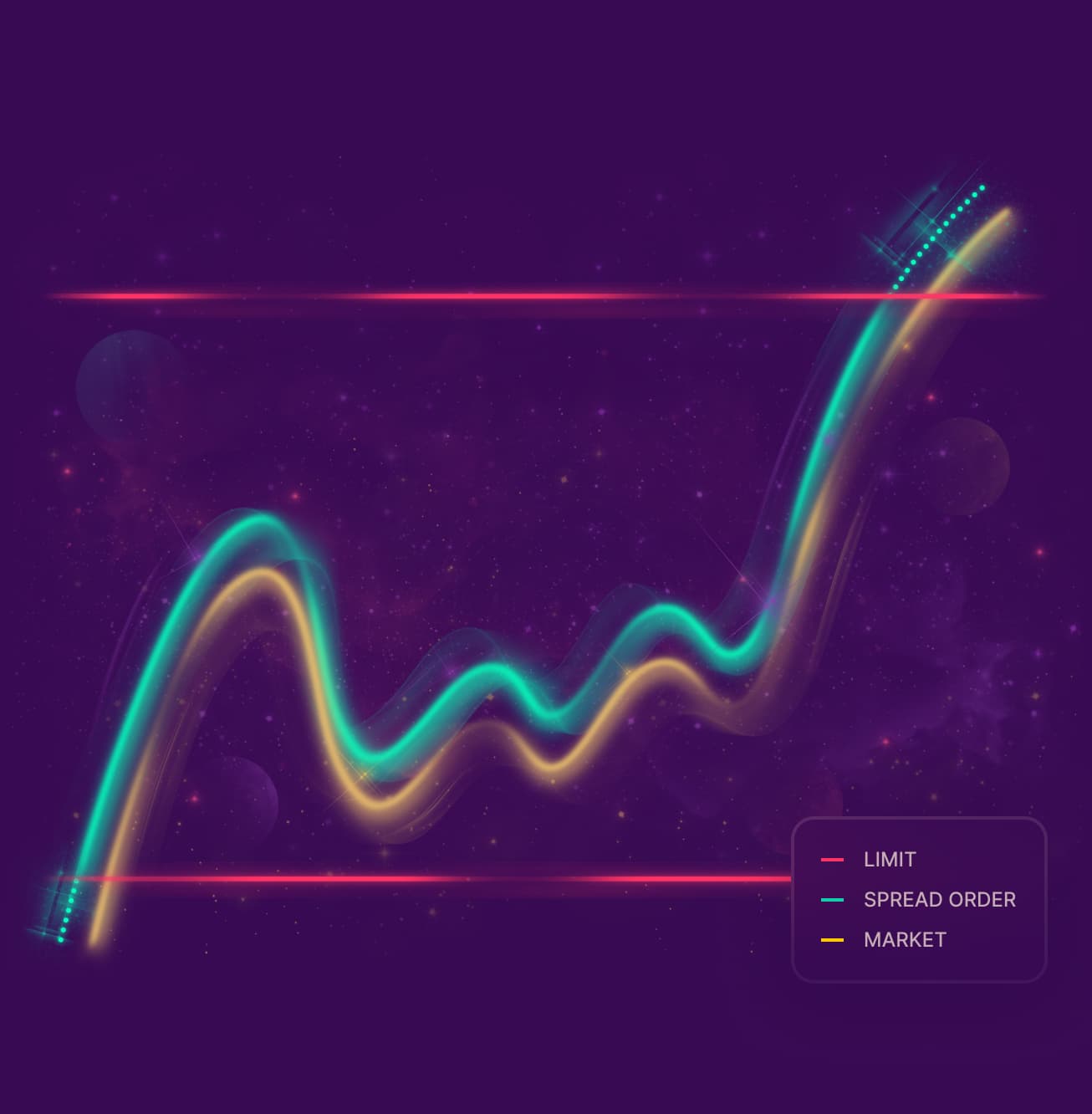

Large trades at low speeds

A private batch solver on SUAVE – that pegs orders to mid-price, settles against all on-chain liquidity, and maximizes CoWs.

Price

time

Settlement

Market + Spread

Market

The deepest book in Defi

Turbine settles agains all on-chain liquidity (DEXs), all off-chain liquidity (through market makers) AND P2P against other Turbine orders – in a single settlement algorithm.

"You build it and they come – it's real!"

-Anon

Orders that never go stale

Limit orders go stale as the market moves. Spread orders let you can choose a fair fee – and your order moves with the market. Never going stale.

Combine with limits to define upper and or lower limits for your execution

Combine with limits to define upper and or lower limits for your execution

"All flow in one PR – still can't believe it."

-Anon

Invisible orders

Turbine is 100% confidential and trustless. Your order is stored exclusively on SUAVE TEEs, settled by a TEE Solver through a TEE Builder.

"We stole 50% of Curve's lunch in the first week."

-Anon

Coming soon

Passive Liquidity with no LVR

Turbine Uni4 pools settle only at true current market price + fees. Protected by the speedbump, and liquidity providers never settle at stale price – and suffer no loss versus rebalancing (LVR).

"All flow in one PR – still can't believe it."

-Anon

Coming soon

Turbine Institutional

Trade privately on-chain, against both on-chain and off-chain liquidity – while staying compliant.

Turbine's institutional order-types and APIs provide an audit trail and settlements only against whitelisted, KYC and AML checked, accounts.

Turbine's institutional order-types and APIs provide an audit trail and settlements only against whitelisted, KYC and AML checked, accounts.

The Speedbump

All orders are private, delayed by one block and settled in batches. This eliminates 98% of all incentives for latency races – and potential for informed flow.

Market prices that Turbine settles at are sourced from the current block – and therefore always more up-to-date that the information traders had when submitting their trade.

This protects every trader, and market maker, and Turbine LPs from toxic flow.

Market prices that Turbine settles at are sourced from the current block – and therefore always more up-to-date that the information traders had when submitting their trade.

This protects every trader, and market maker, and Turbine LPs from toxic flow.

N-Dimensional Orderbook

In normal orderbooks, liquidity is isolated – in Turbine, all orders are part of one N-dimensional orderbook.

Turbine settles in frequent batches over this orderbook and finds multi-party P2P settlements that increase liquidity, and lower spreads drastically.

Turbine settles in frequent batches over this orderbook and finds multi-party P2P settlements that increase liquidity, and lower spreads drastically.

SUAVE SGX

Something about SUAVE TEEs. Placeholder … Placeholder.

Your question answered

Got other questions? Check out our docs

The best prices on large trades

A confidential orderbook on SUAVE – that pegs orders to the market, and keeps out HFT with a speedbump.

OTC desks are intransparent and expensive, and selling privately is a lot of effort – and risky, again if someone frontruns you.

But, making large trades is a pain too. Bots frontrun you, orders get stuck or execute at high slippage. Settlement rates are hit and miss – and so are the price you get. There's not enough liquidity on-chain to execute at small price impact.

This is why we designed Turbine – a trustless, confidential, and n-dimensional orderbook – where your orders settle at exactly the spread you define or better – and you find the deepest liquidity in all of defi.

Combining all on-chain, off-chain and P2P liquidity from other large traders.

But, making large trades is a pain too. Bots frontrun you, orders get stuck or execute at high slippage. Settlement rates are hit and miss – and so are the price you get. There's not enough liquidity on-chain to execute at small price impact.

This is why we designed Turbine – a trustless, confidential, and n-dimensional orderbook – where your orders settle at exactly the spread you define or better – and you find the deepest liquidity in all of defi.

Combining all on-chain, off-chain and P2P liquidity from other large traders.